When done properly, Day Trading can be an incredibly powerful way of earning additional income from anywhere in the world with a wifi connection.

Considering that the global blockchain market might reach $23.3 billion by 2023, there is no surprise that cryptocurrency is attracting a significant number of traders to the Altcoin space.

However exciting crypto trading might be, you need to understand that it is a very high-risk venture due to the markets’ volatile nature and the manner in which you carry out Risk Management will make or break your results.

Therefore, you can’t get into trading crypto without a solid plan and properly set objectives. Having a strategy can go a long way to you benefitting from working alongside Day Trade Masters:

● When first starting out, Wait for Support on Entry Line

● ALWAYS Practice Proper Risk Management

● NEVER forget to “Lick Your Ice cream”

● Adjust Stop-Limit as we establish new support levels

● If you miss a trade, don’t ape in. A patient ninja is an effective ninja.

Without further ado, let’s take a look at five strategies you can use to ease your way around crypto trading.

1. Day Trading as an Additional Income Stream

Getting started successfully with Bitcoin & Digital Assets has never been easier. Simply follow our Blueprint with various resources and strategies at your disposal.

Essentially, there are two types of trading strategies you can choose from:

● Farming (Compounding)

○ Requires a more hands-on approach and it implies close monitoring of the market

● Set & Forget

○ You have more flexibility as a trader and it doesn’t involve you closely setting alarms or checking in on trades regularly

If you are to adopt a Farming strategy, the biggest thing to factor is time at the desk. Going down this route, you will need to enter and exit positions multiple times per week and will be adjusting stop losses just as often. The aim here is to profit from market volatility and compound efforts while minimizing risk to zero by adjusting Stop-Limits to our Entry Levels and then securing profit at TP levels. As resources to assist you with this strategy you should focus on technical analysis and studying price action. Given that you need to be quick when making decisions, day trading is best suited for more advanced traders.

Our Set & Forget strategy is for additional positions that are more explosive in nature, or for Traders who have busier lives and can’t spend as much time making adjustments or tracking trade progress. Setting Stop-Limits can be tricky at first but with our free materials, weekly live trainings, and timely updates for upgraded subscribers, you are in good hands.

2. Free Trade Setups & How to Use Them

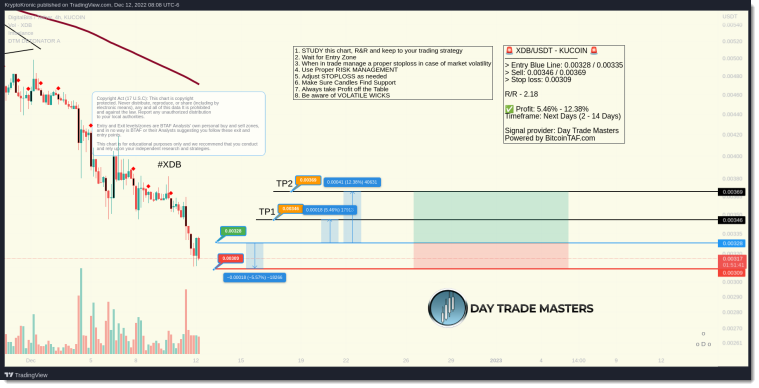

🚨 XDB/USDT – KUCOIN 🚨

——————————

> Entry Blue Line: 0.00328 / 0.00335

> Sell: 0.00346 / 0.00369

> Stop loss: 0.00309

R/R – 2.18 Subscribe for Higher TPs

✅ Profit: 5.46% – 12.38%

Timeframe: Next Days (2 – 14 Days)

Signal provider: Day Trade Masters

Powered by BitcoinTAF.com

——————-

Free Trade Setups are posted once a week and introduce newer users to the concept of Day Trading without having to purchase a 3 months subscription. You can use the Farming or Set & Forget strategies for both Free Trade Setups and the Upgraded Trade Setups that have been as high as TP8 and over 110% profits. Typical time requirements are 2-4 hours per week with our upgraded setups and less than 30 minutes per week with the Free.

If becoming a Day Trader and earning additional income while enhancing long-term profitability appeals to you, keep in mind:

● You need to replicate the charts we put out and set alerts

● ALWAYS set Stop-Limits and adjust as the trade progresses

● There WILL be losses, sometimes the best trade is no trade at all if markets are working against us

3. What the heck does “Wait for Support” Mean?

Waiting for support on Entry can mean the difference between “getting frustrated and taking a break from the desk” and “enjoying life until the trade proves direction and hopping in for easy profits”.

In the above image, we can see that XDB broke above our Entry (perfect) and has come down to make previous resistance support (don’t worry if this doesn’t make sense right now). The price has come down and shown strength right on our Entry Line, this trade is now active and is ok to add a position and then add our Stop Loss and Take Profit Levels (discussed next).

The next candle pumped up into our TP1 for 5.31% profit in just 8 hours. This is where we want to be adjusting our Stop Limit to Entry (0.00328 in this example)

BTC then dropped, taking the rest of the market with it. This is why we need to protect our capital and take profits (aka “lick our icecream”) of the table before someone does it for us.

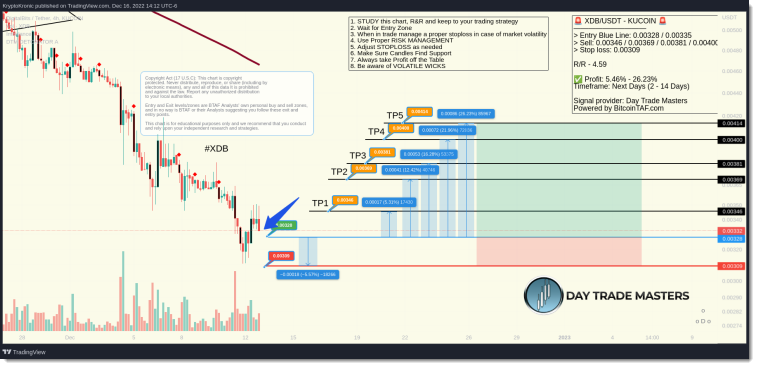

4. Take Profit Strategy

You can take profits multiple times with the same trade setup in a given time period like pictured above (8 times!). Easier said than done, but that’s why consistently working to improve yourself as a trader is so important. When you can find the right entries, the rest takes care of itself.

The typical standard we use is 25% at TP1, 50% at TP2 and the remaining 25% of each trade allocation to be left in Stop Limit orders in case of a further breakout. This secures profits and can be used as often or as little as your life permits.

This particular Trade Setup had 6 TP1s, 2 TP2s and a TP4 with a peak of 77% from Entry! This was in a 28-day period (instead of the typical 14) but you can still see how powerful this can be to rapidly growing your portfolio while replacing your income or generating additional income on the side.

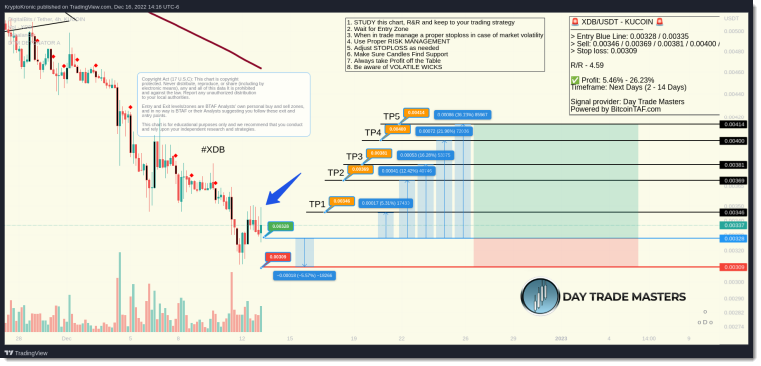

5. Adjusting Stop-Limits

Any profits are good profits and certainly better than a loss. Adjusting your stop-limit as the trade progresses is the difference between a Full-Time CryptoNomad travelling the world and living a free life with his family and friends, and a very expensive hobby.

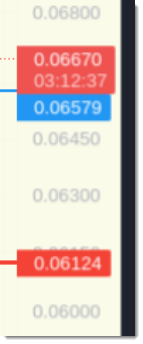

Just like there are many opportunities for Entries, you have just as many opportunities to adjust your Stop-Limit. We know exactly when the candle will close based upon the ticking-down clock on the side of the screen.

Using previous candle-closes is an easy beginning to better executions when it comes to Stop Limits. As your skills evolve as a Day Trader there will be more advanced methods to enhance your results and more time-saving strategies on this covered in The Ultimate Day Trading Course.

Ready to Enhance Your Results with Crypto Trading?

At the end of the day, having all the knowledge in the world won’t be of any use if you don’t listen to the easiest lesson of them all — don’t be afraid to take the theory and put it into practice. We hope that the strategies we have gone through in this article have helped in terms of figuring out what type of time commitments you have as your Crypto Journey evolves.

The good news is that no matter what type of trader you are, we are here to guide you through the complex and volatile world of crypto and DeFi. Why not Apply for our 1on1 Coaching & Coinsulting Programs Today and let us take your crypto trading skills to the next level?

For more information:

Day Trade Masters: https://btaf-wordpress.cloudmlmdemo.com/product/day-trade-signals

The Ultimate Trading Course: https://btaf-wordpress.cloudmlmdemo.com/product/Ultimate-Day-Trade-Training-Course